Bethenny Frankel is everywhere these days. Far gone is the time when you could only catch her on The Real Housewives of New York City or handing out Skinnygirl samples at the grocery store — now she’s going viral on TikTok, being meme-d left and right and even doing glossy, conceptual photo shoots.

“I don’t know when I became so hip,” she tells me via Zoom. “This is getting a little weird.”

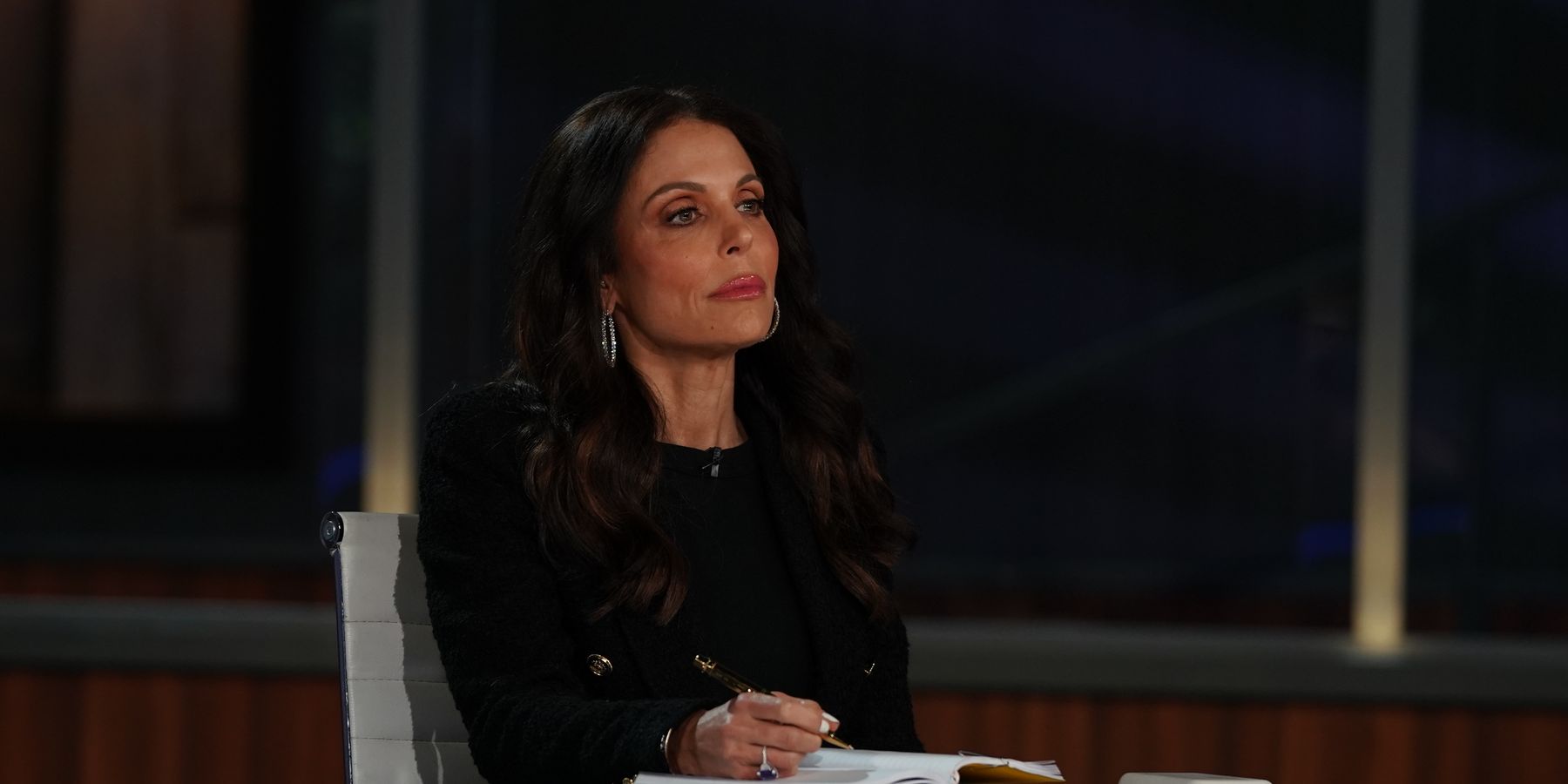

Most recently, though, Frankel has taken up residence as a judge on CNBC’s Money Court, where she and co-host Kevin O’Leary adjudicate over high-stakes business-related financial dilemmas. Frankel is no stranger to money, having spent much of her adult life hustling as an entrepreneur, but presiding over judiciary processes is new, even for her.

“I expected it to be a gender struggle, kind of, but it ended up just being a major learning experience all around,” Frankel says, adding that it’s been “the best television experience” she’s ever had.

With so much money expertise under her belt, we asked Frankel the question on everyone’s mind: How can we get (and stay) rich? Frankel, first and foremost a professional, answered by putting together a list of savvy savings and business tips for younger generations — and told us there’s one get-rich-quick trap, in particular, she’d avoid falling into.

“Influencers,” she says, shaking her head, “everyone wants to be an influencer.”

Check out Bethenny’s tips for getting rich creating a fruitful, long-lasting financial situation for yourself below.

Invest conservatively when you have a steady income. When that money starts to make money, increase the risk slowly as you play with the house’s money.

When I first started making money, I didn’t know what goals I had or what I wanted — I just really didn’t want my money to be in my mattress. Everyone has a different style. Some people can handle the highs and the low more, they can be on a rollercoaster. And as you start making money, you can take on more risk, the pie changes, and that money makes money, and that’s when you can have a little more fun with things based on your instincts.

Use your own personal habits and what you see around you to decide how business will change.

So for example, when the pandemic first hit, it was like the snow globe is being shaken — so where’s everything gonna settle? Where are the fish gonna be? So if you thought about, oh, people will be ordering things to their houses, or learning from home, or real estate fluctuations. It’s really your gut instinct.

Now, on the other hand, things are tightening up a little. People are gonna get a wake-up call. Luxury goods have been so explosive, people have been living like the ‘80s. Now there’s going to be a correction. Buy the dip, if you’re that type of person, or wait for real estate to go down if you want to fix something up.

Try to invest in real estate but only if you’re willing to hold it for a long time or if you’re willing to put a lot of work into renovating and adding value.

Or if you’re willing to put in blood, sweat and tears. Most people don’t want to do work, we’re the Starbucks drive-thru generation now. We want to know when we get the key and move in there’s a gym and a dry cleaner and we want it all in the building. Me, I want to add value and enjoy. I like looking at something and seeing the vision and being creative about it — that’s where you can invest and make money.

Have a discipline and take out a certain amount of money monthly that goes towards savings.

Wherever you put things, don’t touch the principal. That’s the only big rule: Don’t touch the principal, whatever that is. Start your nest egg, and unless it’s life or death, you don’t need the shoes. Don’t touch it unless it’s something you know is going right back in there, like a guaranteed payment that you know will be coming.

Understand taxes and write-offs; understand what your accountant is talking about.

Understand it conceptually at the very least. Same thing with lawyers, I’m not good at that. Even if you don’t understand the contract, understand the concepts. I want to be talked through it. Also, crowdsource, ask different people for advice until you get the right answer. Crowdsourcing is like gathering different ingredients, but then you decide how you’re gonna make the recipe.

Don’t waste money on services that you can execute yourself.

There are all these fantasy, fairy tale services — where you think there’s a wizard and they know how to do it best. Like, if someone’s doing brain surgery, they should have gone to medical school. But marketing, social media, there is no magic wand. This is just a person who is on social media and knows how to connect the dots and be a networker. And whatever it is, it has to be your voice anyway. Yes, I know that at Coca-Cola, the CEO isn’t doing his own social media. But for small businesses — that wizard doesn’t exist.

Understand your brand and your workplace culture and adhere to it. Protect your brand. Protect the realm.

You know what’s on-brand and what’s not, who you are and who you aren’t, what you’ll do and what you won’t. You really have to stick to that. Once in a while, money will come and you’ll make an exception. But you’ll know you’re making an exception. Can your kid stay up till four in the morning? No, my daughter has stayed up until four in the morning probably one time. It has to be a very proactive choice you’re making, and you have to know you’re not protecting the realm at that time. You have to assess the risks of not being on-brand.

It’s like you’re family. I’ve had people on my team that will rat each other out and they’ve gotten fired. The culture is like, you don’t rat your team out. It’s just not part of our culture.

No one will work as hard on your business or know your business like you will. Period. Full stop.

That’s another thing where there’s no wizard. You could hire a president that got paid a million dollars and went to an Ivy League School. They still won’t think about it like you do. They don’t understand it. It’s not their own baby, it never will be. The president of your company, the people you hire, they are step-parents to the child. Very rarely is it the same.

Business and success take relentless hard work. Whether at a corporate job or your own business, it honestly never sleeps.

We could talk about work-life balance all day and yeah, it works. And it’s great, and it’s nice, and as a boss I really want to find that everyone’s happy. But truth be told, truly successful people that really nail it in business — even if they’re physically stopped, they’re not mentally stopped. They can do a yoga retreat, yes, but it’s just a full-time life experience.

I saw that with Kevin [O’Leary]. He’s drinking his wine, he’s eating his pizza, he’s travling on his boat, but he’s always got something cooking. Something’s still on that stove. Tremendous success has a price.

Work-life balance exists but it is a discipline to be managed because tremendous success has a price.

I’ve interviewed enough moguls to know the threads and commonalities. I didn’t make this stuff up. I’ve spoken to everyone from Sheryl Sandberg to Mark Cuban to, you know, Matthew McConaughey. They relax, they have lives, they have families. It doesn’t mean you’re an animal. It just means they’re always on top of it in some way.

Successful people are in their businesses because they love what they do — not for the money. Then the money comes.

It’s just who they were born to be, it’s who they evolved into — but they are not money-driven. They’re not stupid, they know their value, they’re not going to do things they don’t want to for free, but they are not driven by money. Money has come, and then money becomes currency, but it is not the driving force.

Business is personal.

Anything that has risk and takes time away from your personal life and family is personal. Who you are in life is who you are in business.

Photos courtesy of CNBC/ Jeff Daly

From Your Site Articles

- Bethenny Frankel Calls Out Fake 'Champagne Socialists' ›

- Real Housewives Of New York - PAPER ›

- Bethenny Frankel Says Kylie Jenner's New Makeup Is a 'Scam' ›

Related Articles Around the Web